In instances of medical crisis, having health insurance comes in handy. Healthcare expenses in the nation have increased substantially in recent years due to the nation’s ever-increasing demand for health care services. This, combined with an increased understanding of health and sickness prevention, has generated medical insurance even more crucial. In times of medical crisis, having health insurance comes in handy.

Reasons Why Having Medical Insurance Is Crucial

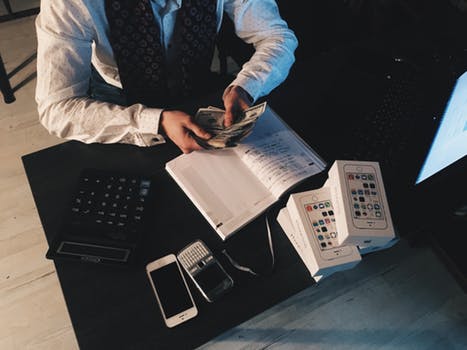

Many men and women are forced to use cash from their savings in a medical crisis, which hurts their financial health and jeopardizes personal ambitions. By carefully analyzing the financial situation and needs, one might plan for and financially prepare for medical crises with the help of a medical insurance plan. Read on to learn about some of the most crucial benefits of obtaining medical insurance.

Medical Services Are Costly

The expanding expense of health care necessitates the purchase of suitable medical insurance coverage. Experts think that investment selections are only profitable for health insurance if they’re educated and well-researched. As a result, proper medical insurance coverage may shield against inflation.

Flexibility

Insurers now provide a diverse variety of health insurance packages with several features and benefits to pick from. Due to the enormous diversity accessible today, hundreds of choices are offered for the potential policyholder to match their health requirements. That is why experts frequently emphasize the need to know about various insurance components to meet one’s insurance requirements efficiently.

No-Claim Bonus or Cumulative Bonus

Suppose a policyholder doesn’t submit a claim against a health insurance plan in a specific year. The insurance company will pay a bonus. A health insurance program may not offer the necessary coverage in the initial year. Still, it may deliver a huge sum as a cumulative bonus in later decades. Some insurers give this advantage in the form of a reduction in the premiums due in succeeding years. Others, on the other hand, provide this advantage as a combination of both.

Pre- and Post-Hospitalization Expenses Are Covered

In some healthcare programs, most insurance companies pay both pre-and post-hospitalization expenditures. Basic therapy expenses are covered, as are some additional costs incurred as a result of testing and testing fees. However, there are temporal restrictions that have to be met to obtain such coverage. What’s more, shipping costs are often covered by insurance.

Riders

Medical insurance policy comes in many different shapes and sizes. Some insurers cover preventative check-ups and physician’s consultation fees as part of their healthcare insurance policies. Others provide coverage for various essential ailments. A rider supplies technical benefits under coverage and primary features under specified scenarios.

No-Cash Service

Many medical insurance providers such as GMS now give a cashless facility with their plans under specific conditions within a designated hospital community. This can be especially advantageous because, in the event of an emergency, the insurer pays for qualified fees directly to the establishment, eliminating the need for the policyholder to pay off the costs out of pocket. This similar functionality makes sure that customers are not affected by abrupt financial requirements in an emergency.

Health Examinations

Among other benefits, several medical insurance coverages include free periodic health check-ups under certain conditions. These check-ups are usually covered by a cashless approach in which the insured isn’t forced to pay the bill from their money.

Conclusion

Family health insurance, individual health insurance, critical illness insurance, and personal accident insurance, Personal, Private, and Self-Employed Health Insurance Coverage Plans | GMS Canada among others, are currently available on the market. According to financial experts, having health insurance is an essential element of financial planning. Click here and talk to us.